Content

Table 8 is the empirical analysis results of the five sample industries. A depreciation tax shield is one of the measures through which tax is to be reduced. It is inversely related with the tax payments higher the depreciation tax shield lower will be the depreciation.

Salvage ValueSalvage value or scrap value is the estimated value of an asset after its useful life is over. For example, if a company�s machinery has a 5-year life and is only valued $5000 at the end of that time, the salvage value is $5000. You are required to compute and analyze cash flow and advise which option is better. Helping private company owners and entrepreneurs sell their businesses on the right terms, at the right time and for maximum value. Table 9 shows the results of the robustness test of the sample data.

Tax shield definition

In addition, capital gains taxes receive a 20% deduction for the donated asset. If your out-of-pocket medical costs were more than 7.5% of your adjusted gross income last year, you’ll gain this tax shield. You had $10,000 of medical costs last year, meaning you’ll receive a $6,250 deduction for medical expenses. So, if you had total deductible expenses of $15,000 and a tax rate of 20%, your tax shield is $3,000. A Ltd has purchased the asset amounting to $ 500,000 and depreciation is on straight-line basis for 5 years i.e. depreciation per year is $ 100,000. Calculate the depreciation tax shield and the net operating profit.

Note that the Bu does not properly account for the reduction in economic leverage caused by the reduction in fixed obligations. Why these fancy professors and consultants cannot figure this out is stupifing. In valuation and finance texts including texts by Damarodan and the McKinsey Valuation book, various methods are typically described. Some of the most irritating discussion is in a HBS article that seems to promote the APV method as some sort of advanced method that better reflects management strategy. An example of discussion of different methods that say nothing about any underlying theory of how tax shields should be value is illustrated below.

Articles

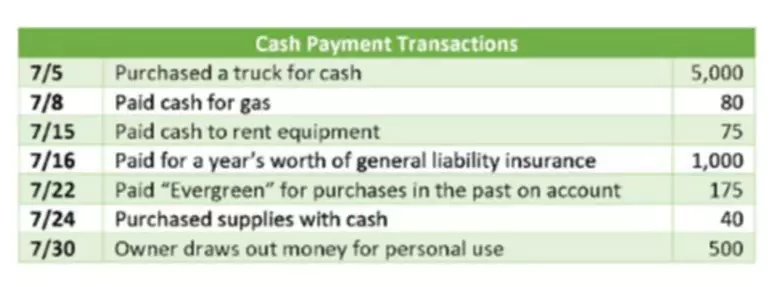

The cost of interest appears elsewhere on the cash flow statement as a payment to the lender. However, this is the cost of doing business that the company would incur regardless of its tax implications. Some cash flow statements can show multiple tax shields, each based on a simple multiplication, which can be added together to determine the total tax shield value for the period of time that the statement covers. Specifically, there is a significant positive correlation between the corporate asset-liability ratio and the actual tax rate.

Late Subway co-founder�s stake donated in potential tax shield � Yahoo Finance

Late Subway co-founder�s stake donated in potential tax shield.

Posted: Wed, 01 Feb 2023 08:00:00 GMT [source]

On the right hand side of the diagram, the loan is assumed to have a tax shield from a tax rate of 40%. This means that even thought the nominal loan balance is 60,000, because the interest payment is lower , the effective leverage to you should be computed from the lower interest payment. Note that the reduced interest below the market could come from some kind of gift from God or other subsidy. But the market cost of capital or interest rate on debt remains at 10%. This is because the entity giving you the loan faces the same economy-wide interest rates and risks. Therefore, the value of the fixed obligation at market value should still be discounted at a rate of 10%. In terms of valuation, assume the beneficial tax shield can be assumed by a new buyer.

29: Tax shields

Now that you know how to use them, don’t spend all your time calculating tax shields. Most require significant expenses that need to be considered along with other factors. If you use good tax software, it will automatically prompt you to use the best deductions and strategies. You may have heard that a large charitable donation was “just a tax write-off.” This is partially true, since donating to approved charities can be written off of business taxes. However, keep in mind that, based on the tax shield formula, the tax shield is just the donation multiplied by the tax rate. You may have heard of tax shield depreciation in connection with your residence.

- The gross interest and the tax shield is computed from the gross debt value.

- Interest paid on mortgages and student loans can become a tax shield.

- If your income falls on the higher end of the spectrum, you can still save money when you file.

- There are cases where income can be lowered for a certain year due to previously unclaimed tax lossesfrom prior years.

- This happens through claiming deductions such as medical expenses, mortgage interest, charitable donations, depreciation, and amortization.

- Depreciation is the non-cash expense hence with the proper planning the net operating cash flows can be increased and better management of funds are to be done.

The tax shield is an important benefit for companies because it allows them to keep more of their profits, which can be used to finance new investments or pay dividends to shareholders. A tax shield is the reduction in income taxes that a company achieves due to the use of certain tax-deductible expenses. These tax-deductible expenses can include items such as depreciation, interest payments, and research and development expenditures. When a company incurs these expenses, it can shield a certain amount of its taxable income from income taxes.

What is a Tax Shield?

Tax Shieldes can take a depreciation expense for buying business property, including equipment, furniture and fixtures, and vehicles . Depreciation is basically a way to spread out the expense of buying a business asset over the life of that asset. Accelerated depreciation allows you to depreciate more of the asset in the first year or two, and it�s a great example of a tax shield.

- In addition, governments often create tax shields to encourage certain behavior or investment in certain industries or programs.

- A depreciation tax shield is one of the measures through which tax is to be reduced.

- Since depreciation expense is tax-deductible, companies generally prefer to maximize depreciation expenses as quickly as they can on their tax filings.

- In this case, the nominal amount of the debt at an interest rate of 10% yields a value of equity 40,000 because of the debt that has a value to both investors and to you of 60,000.

- Incurring debt, in order to charge off the related interest expense as a taxable expense.

- Tax Shield FormulaTax Shield refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed to the government.

A https://www.bookstime.com/ shield is a legal way for individual taxpayers and corporations to try and reduce their taxable income. The total value of a tax shield is going to depend on the tax rate of an individual or corporation and their tax-deductible expenses. The main change is the reduction in income tax rates, beginning with 2018 taxes. The corporate tax rate has been reduced to a flat 21%, starting in 2018, and personal tax rates have also been reduced. McKinsey, Damoradan and other finance professors continue to confuse the issue.

Terakhir disunting : 3 years yang lalu..